Introduction

Getting a home insurance estimate is often treated as a quick checkbox on a long list of homeowner tasks. You answer a few questions, see a price, and move on—sometimes without a second thought. However, this moment is far more important than most people realize.

The biggest mistake homeowners make when getting a home insurance estimate isn’t choosing the wrong company, skipping discounts, or even paying too much. Instead, the real problem is relying on assumptions instead of understanding what the estimate is actually measuring.

That single oversight quietly shapes coverage decisions, premium costs, and claim outcomes—often for years. Worse still, most people don’t discover the consequences until something goes wrong.

In this article, we’ll break down that mistake in depth, explain why it happens so often, and show you how to avoid it entirely. Along the way, you’ll learn how insurance estimates are calculated, what truly influences pricing, how location plays a role, and how to get a fast estimate without sacrificing accuracy or value.

Why Home Insurance Estimates Feel Deceptively Simple

At first glance, insurance estimates appear straightforward. Modern tools promise instant results, minimal input, and quick comparisons. As a result, many homeowners assume the estimate itself is precise, complete, and final.

However, that perception is misleading.

In reality, an estimate is a projection, not a promise. It’s based on approximated information and model-driven assumptions rather than exact figures. While those models are useful, they’re not personalized unless you actively make them so.

Because of this, the most dangerous mistake is not questioning what the estimate is based on.

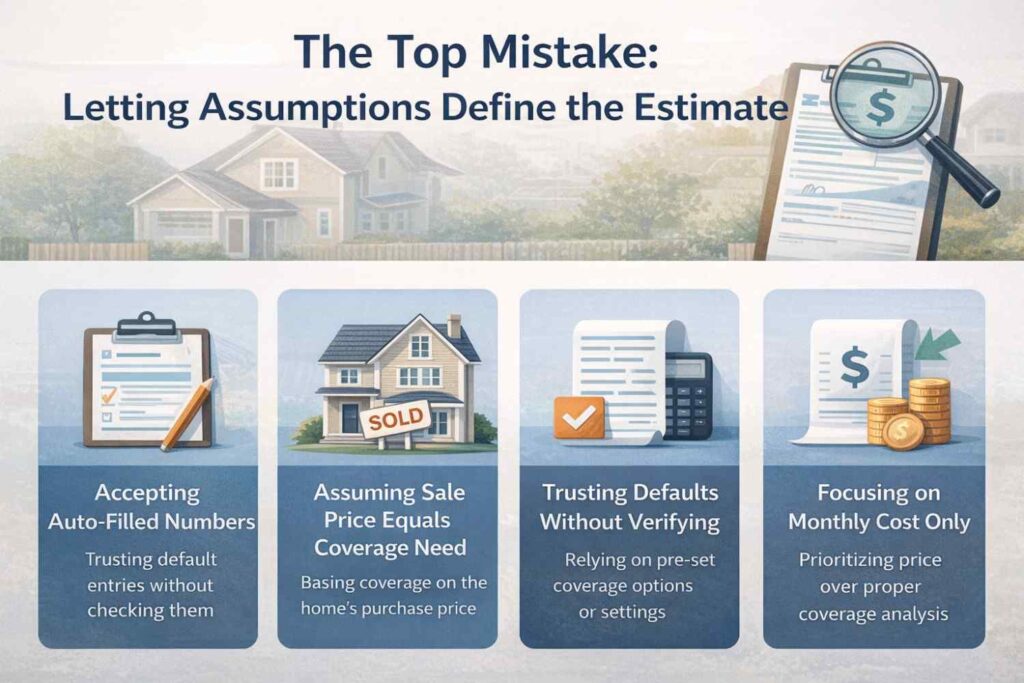

The Top Mistake: Letting Assumptions Define the Estimate

The most damaging error homeowners make is allowing the insurance estimate to be shaped by assumptions instead of facts.

Specifically, people often:

- Accept auto-filled numbers without reviewing them

- Assume the home’s sale price equals coverage needs

- Trust default settings instead of verifying details

- Focus on monthly cost rather than coverage accuracy

Individually, these choices seem harmless. Collectively, they create insurance coverage that doesn’t reflect reality.

Also, According to guidance from the National Association of Insurance Commissioners (NAIC), homeowners insurance should be based on rebuilding costs rather than market value, a distinction many estimates fail to clarify.

Why Assumptions Are So Common in Insurance Estimates

This mistake isn’t caused by carelessness. In fact, it happens because the system encourages it.

Speed Is Prioritized Over Understanding

Online insurance estimators are designed for convenience. The faster an estimate appears, the more likely users are to complete the process. As a result, important details are simplified—or skipped entirely.

While speed is helpful, it often comes at the cost of understanding.

Homeowners Anchor to Familiar Numbers

People naturally gravitate toward numbers they already recognize, such as:

- Purchase price

- Online valuation estimates

- Property tax assessments

Unfortunately, insurance pricing doesn’t rely on these figures. Even so, because they feel “official,” homeowners often treat them as accurate inputs.

Insurance Terminology Creates Confusion

Terms like coverage, limit, value, and cost are frequently used interchangeably in everyday conversation, but they mean very different things in insurance.

As a result, homeowners may misunderstand what they’re actually insuring—and why it matters.

How Home Insurance Estimates Are Actually Built

To avoid this mistake, it helps to understand how insurance estimates are created behind the scenes.

Insurance providers rely on multiple layers of data, including:

- Property characteristics

- Local and regional risk profiles

- Construction cost indexes

- Historical claims data

- Statistical modeling

However, even the most advanced systems depend on accurate inputs. When assumptions replace verified details, the estimate quickly drifts away from reality.

The Hidden Cost of “Good Enough” Estimates

When homeowners rely on assumptions, two common outcomes emerge—both problematic.

Also, While this article focuses on home insurance estimates, the broader issue of relying on assumptions instead of understanding coverage applies across insurance types. In a related discussion on long-term protection, we’ve explored how clarity and informed decision-making shape outcomes in The Quality Role of the Life Insurance New Policies. Just as with home insurance, life insurance policies can fall short when buyers focus on surface-level pricing instead of policy structure, coverage intent, and future needs. The lesson is consistent: understanding what a policy is designed to protect is far more important than simply comparing numbers.

Overestimating What Needs to Be Insured

Some homeowners unknowingly insure more than they could ever recover. This leads to:

- Higher premiums

- No added claim benefit

- Long-term financial waste

Insurance does not reward over-insurance. You can’t profit from a loss, regardless of how high the coverage limit is.

Underestimating What It Takes to Recover

On the other hand, underestimated inputs can leave homeowners exposed. In these cases:

- Claims may not fully cover rebuilding

- Out-of-pocket costs increase

- Recovery becomes slower and more stressful

Ironically, this often happens to homeowners who believed they were saving money.

Location Makes Assumptions Even Riskier

Where your home is located significantly increases the consequences of incorrect assumptions.

Construction Costs Are Not Universal

Rebuilding a home in states like Florida, Texas, California, or disaster-prone regions often costs far more than national averages suggest. Labor availability, materials pricing, and building code requirements vary widely.

Relying on generalized data in these areas can dramatically skew an estimate.

Local Risk Changes Everything

Insurance estimates factor in elements such as:

- Storm frequency

- Wildfire exposure

- Flood risk

- Crime trends

- Emergency response access

If these risks aren’t accurately reflected, the estimate becomes distorted—sometimes by a significant margin.

The Emotional Trap: Chasing the Lowest Number

Another reason this mistake persists is emotional behavior.

When comparing estimates, many homeowners instinctively choose the lowest price. While comparison shopping is smart, price alone never tells the full story.

A lower estimate often reflects:

- Higher deductibles

- Lower coverage limits

- Excluded risks

- Narrow definitions of coverage

Without understanding why an estimate is lower, homeowners may unknowingly accept weaker protection.

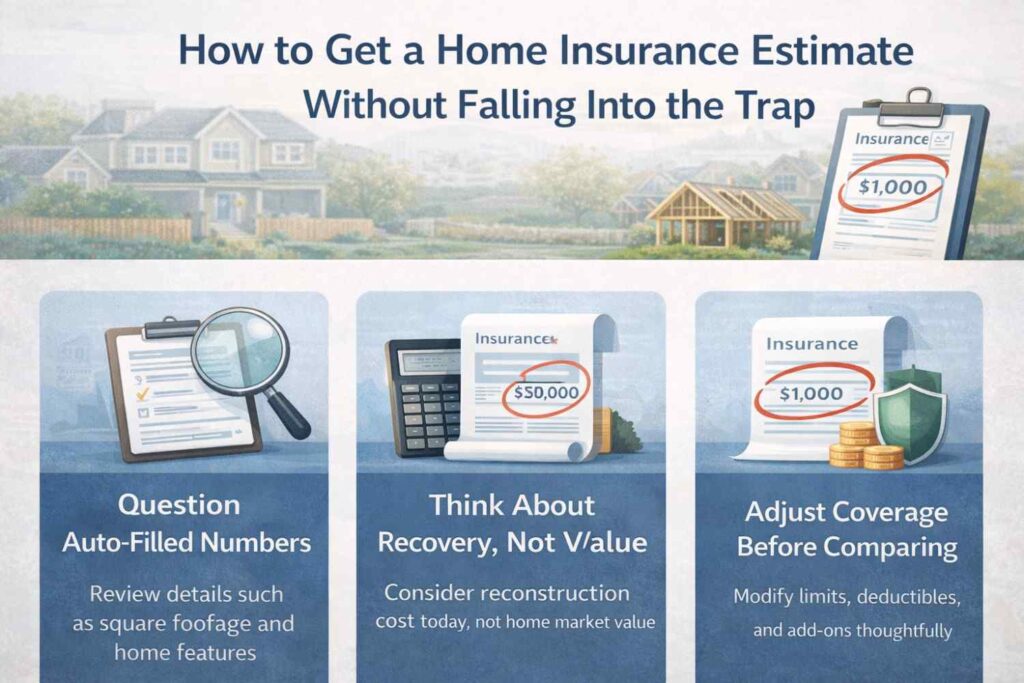

How to Get a Home Insurance Estimate Without Falling Into the Trap

Avoiding this mistake doesn’t require expert knowledge—just a more intentional approach.

Step 1: Question Every Auto-Filled Number

Auto-filled values are starting points, not final answers. Review details such as:

- Square footage

- Home features

- Construction materials

- Roof age and condition

Even small inaccuracies can significantly affect the estimate.

Step 2: Think in Terms of Recovery, Not Market Value

Instead of asking, “What is my home worth?” ask:

How much would it cost to rebuild the home from the ground up today?

This shift in thinking fundamentally changes how coverage decisions are made.

Step 3: Adjust Coverage Before Shopping Around

If an estimate seems high, don’t discard it immediately. First:

- Review coverage limits

- Adjust deductibles carefully

- Remove unnecessary add-ons

Often, costs can be reduced without compromising meaningful protection.

If you want a fast way to sanity-check your numbers before comparing providers, try Florida Home Insurance Calculator. It helps you estimate insurance costs using Florida-specific factors, so you can review coverage choices with more confidence before requesting official quotes.

Secondary Mistakes That Compound the Problem

While assumptions are the root issue, several additional mistakes make matters worse.

Ignoring Updates Over Time

Homes evolve, and so do construction costs. Renovations, inflation, and code changes all affect insurance needs. Estimates should be reviewed annually—not once and forgotten.

Overlooking Personal Liability Exposure

Liability coverage is often undervalued because it’s intangible. However, it protects against lawsuits that could otherwise cause severe financial harm.

Assuming “Standard” Coverage Is Universal

What’s considered standard coverage in one state may be optional—or excluded—in another. This is especially true in high-risk regions.

People Also Ask

A. Because assumptions, data sources, and coverage definitions vary across providers.

A. Yes. Estimates often change after inspections, underwriting, or data verification.

A. No. Insurance estimates typically do not involve hard credit checks.

A. At least once a year, or after major home updates.

The Role of Technology in Insurance Estimates

Modern estimation tools use advanced analytics, mapping data, and cost modeling. While impressive, they are not foolproof.

Technology improves speed and accessibility—but human judgment ensures accuracy.

Why This Mistake Becomes Expensive Over Time

The real cost of assumptions isn’t immediate. It accumulates quietly:

- Overpaying drains cash year after year

- Underinsuring increases stress during loss

- Incorrect coverage delays recovery

- Trust in insurance erodes

All of this stems from one overlooked moment.

A Better Way to Think About Home Insurance Estimates

Instead of treating estimates as final prices, think of them as planning tools.

They exist to:

- Reveal risk

- Guide decisions

- Prompt better questions

When used correctly, estimates empower homeowners rather than confuse them.

Final Thoughts: Awareness Is the Real Savings

The most costly mistake people make when getting a home insurance estimate isn’t technical—it’s mental.

By allowing assumptions to guide the process, homeowners give up control. By slowing down, questioning defaults, and focusing on real-world recovery, they regain it.

The smartest insurance decisions aren’t rushed or reactive. They’re informed, intentional, and reviewed regularly.

If you understand what your estimate is actually telling you, you won’t just save money—you’ll protect your future.