Introduction

Getting a free home insurance estimate is often the first step homeowners take when buying a house, renewing a policy, or trying to reduce insurance costs. While the process appears simple on the surface, many people walk away with numbers that don’t truly reflect their home, their risks, or their financial needs.

As a result, homeowners may overpay for years or discover—too late—that their coverage falls short when it matters most.

This guide exists to change that.

In the sections ahead, you’ll learn how to get a free home insurance estimate that is fast, accurate, and genuinely useful. More importantly, you’ll understand why each step matters, what insurers evaluate behind the scenes, and how location, home details, and coverage choices shape the final outcome.

Whether you’re a first-time buyer or a long-time homeowner, this step-by-step guide will help you estimate smarter, compare confidently, and avoid costly mistakes.

What Is a Free Home Insurance Estimate?

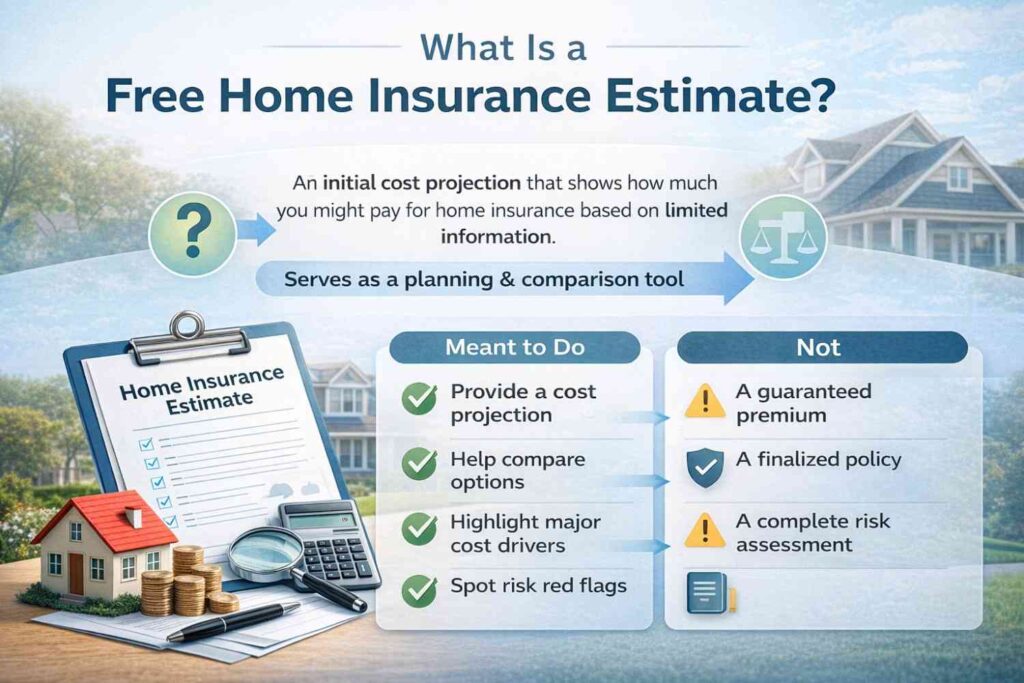

A free home insurance estimate is an initial cost projection that shows how much you might pay for homeowners insurance based on limited information. Unlike a formal quote, an estimate does not require underwriting, inspections, or binding commitments.

Instead, it functions as a planning and comparison tool.

What an Estimate Is Meant to Do

- Provide a general price range

- Help compare coverage options

- Highlight major cost drivers

- Identify potential red flags

What an Estimate Is Not

- A guaranteed premium

- A finalized policy

- A complete risk assessment

Understanding this distinction is essential before moving forward.

Why Getting a Free Estimate Is Important (But Not Enough)

Getting a free home insurance estimate is often the first step homeowners take when buying a house, renewing a policy, or trying to lower costs. Using a reliable free home insurance estimator helps ensure those numbers reflect real rebuilding costs and local risks.

On one hand, estimates allow you to:

- Shop without pressure

- Explore coverage options

- Budget more accurately

On the other hand, relying on estimates blindly can lead to:

- Overpaying for unnecessary coverage

- Underinsuring critical areas

- Misunderstanding policy limits

The real value lies not just in getting an estimate, but in knowing how to guide it.

Step 1: Gather the Right Information First

Although many tools promise instant results, accuracy improves significantly when you prepare a few details in advance.

Essential Information to Have Ready

- Property address and ZIP code

- Home type (single-family, condo, townhouse)

- Square footage

- Year built

- Number of stories

- Roof type and approximate age

- Construction materials (frame, brick, masonry)

- Occupancy (primary, secondary, rental)

Even when tools auto-fill data, reviewing it manually helps prevent errors that can distort results.

Step 2: Understand How Location Shapes Your Estimate

Location is one of the strongest influences on home insurance estimates.

Why ZIP Code Matters

Insurers assess risk at a local level by factoring in:

- Weather patterns

- Natural disaster history

- Crime rates

- Fire department proximity

- Building code requirements

As a result, two similar homes in different ZIP codes can receive vastly different estimates.

State-Specific Considerations

- Florida: Hurricanes, wind coverage, flood exclusions

- Texas: Hail and windstorm exposure

- California: Wildfire risk and rebuilding costs

National averages rarely apply accurately to individual homes.

Step 3: Focus on Rebuild Cost—Not Sale Price

One of the most important steps is understanding what the estimate is actually insuring.

Home insurance is designed to cover reconstruction, not resale value.

Also, Many homeowners make the mistake of treating free estimates as final answers rather than planning tools. In a deeper breakdown of this issue, we’ve explained how common assumptions quietly distort coverage decisions in Learn About Home Insurance Estimate Mistake. Understanding these mistakes alongside the step-by-step process outlined here helps homeowners avoid inaccurate inputs, unrealistic expectations, and long-term coverage gaps.

What Rebuild Cost Includes

- Materials and labor

- Demolition and debris removal

- Permits and inspections

- Code upgrades

What It Does Not Include

- Land value

- Market demand

- Neighborhood appreciation

Using purchase price or market value as a proxy often leads to inaccurate estimates.

Step 4: Choose Coverage Levels Intentionally

Once the base estimate is generated, the next step is refining coverage.

Core Coverage Areas

- Dwelling (structure)

- Personal property

- Liability protection

- Loss of use

- Other structures

Rather than accepting default settings, review each category carefully. Small adjustments here often improve value without sacrificing protection.

Step 5: Select a Deductible That Fits Your Financial Reality

Deductibles have a direct impact on your estimate:

- Higher deductible → lower premium

- Lower deductible → higher premium

The goal is balance. Choosing the highest deductible to save money can backfire if you can’t comfortably pay it after a loss.

Step 6: Review Optional Coverages Thoughtfully

Not every endorsement is necessary, but some are critical depending on location and lifestyle.

Common Add-Ons to Consider

- Flood insurance (separate policy)

- Wind or hurricane endorsements

- Ordinance or law coverage

- Scheduled personal property

Evaluate relevance based on actual risk exposure rather than adding coverage “just in case.”

Also, Flood damage is not covered under standard homeowners insurance policies, even when flooding results from storms or hurricanes. According to FEMA’s National Flood Insurance Program (NFIP), flood insurance must be purchased as a separate policy and is available to homeowners, renters, and property owners in participating communities. Even homes located outside high-risk flood zones can experience flooding due to heavy rainfall, drainage issues, or storm surge. Evaluating flood exposure and understanding NFIP coverage options is an important step when reviewing optional coverages, especially for homeowners in coastal areas or regions prone to seasonal flooding.

Step 7: Generate Multiple Free Estimates

One estimate provides insight. Multiple estimates provide clarity.

However, comparisons only work when coverage is aligned.

How to Compare Correctly

- Match dwelling limits

- Match deductibles

- Match endorsements

Otherwise, you’re comparing different products—not prices.

Step 8: Look Beyond the Price Tag

While cost matters, it should never be the sole decision factor.

Also evaluate:

- Coverage definitions

- Exclusions

- Claim reputation

- Financial stability

A lower estimate may indicate narrower protection rather than better value.

Step 9: Identify Red Flags in Estimates

Some warning signs deserve closer attention.

Potential Red Flags

- Extremely low estimates

- Missing liability coverage

- No explanation of assumptions

- Outdated home details

If an offer seems unusually cheap, it’s worth investigating further.

Step 10: Update Your Estimate Regularly

Homes change. Costs change. Risks change.

When to Re-Estimate

- Annually

- After renovations

- After roof replacement

- After major regional events

Regular updates prevent silent underinsurance and unnecessary overpayment.

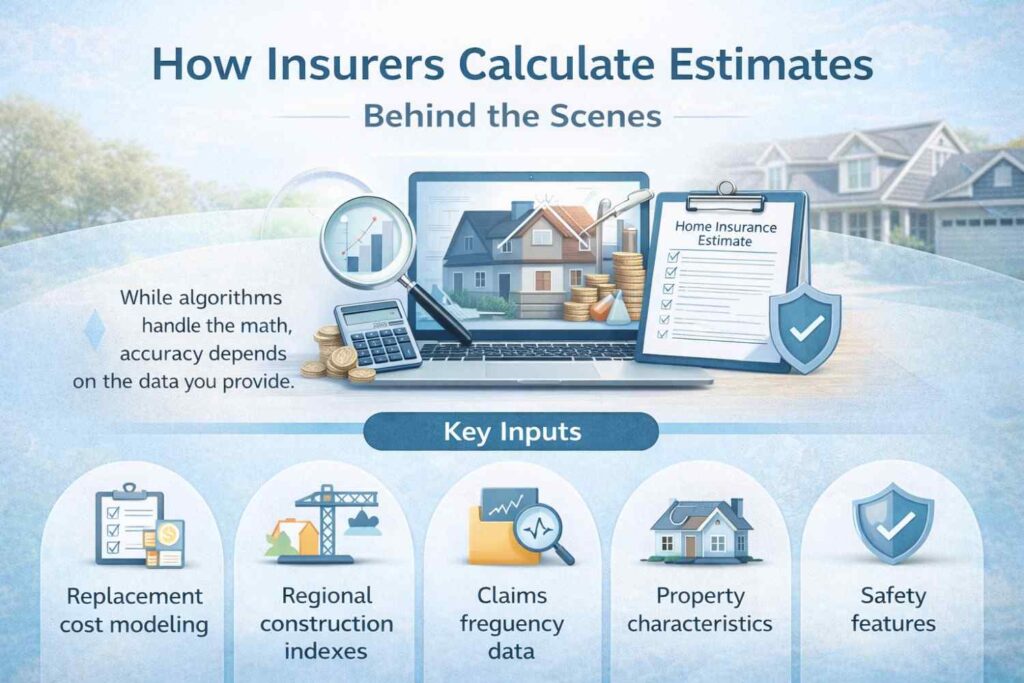

How Insurers Calculate Estimates Behind the Scenes

Understanding the mechanics helps homeowners ask better questions.

Key Inputs Include

- Replacement cost modeling

- Regional construction indexes

- Claims frequency data

- Property characteristics

- Safety features

While algorithms do the math, accuracy still depends on the information provided.

Quick Answers Homeowners Ask Most

A. It’s a strong starting point, but it may change after underwriting.

A. No. Free estimates do not involve hard credit checks.

A. Typically 2–5 minutes online.

A. Yes, though agent review can improve accuracy.

Technology Is Improving Estimates But Judgment Still Matters

Modern tools use mapping data, AI models, and cost databases. While powerful, they still rely on assumptions and averages.

Human review ensures the estimate reflects real-world conditions, not just statistical norms.

Common Mistakes to Avoid During the Process

Even with good tools, mistakes happen.

Avoid:

- Rushing through inputs

- Ignoring location risks

- Assuming defaults are correct

- Choosing based on price alone

Awareness is the most effective form of savings.

Why Free Estimates Empower Smarter Decisions

When used correctly, free home insurance estimates help homeowners:

- Plan financially

- Understand risk

- Avoid surprises

- Protect long-term stability

They are not sales tools—they are decision tools.

Final Thoughts: Treat Estimates as Strategy, Not Numbers

A free home insurance estimate is more than a price—it’s a snapshot of risk, recovery, and responsibility.

When homeowners slow down, verify inputs, and focus on rebuilding needs rather than assumptions, estimates become powerful allies instead of misleading figures.

The best insurance decisions aren’t made in haste. They’re made with clarity, context, and confidence.

If you approach your next estimate as a guide rather than a shortcut, you won’t just protect your home—you’ll protect your peace of mind.